Intro

Discover the 5 Best Branches for career growth, including finance, technology, and healthcare, offering top job opportunities, high salaries, and skill development in emerging fields like data science and artificial intelligence.

The world of banking and finance is a complex and multifaceted one, with numerous branches and specialties that cater to different needs and goals. For individuals looking to start a career in this field or simply wanting to understand the various options available, it's essential to explore the different branches that exist within the industry. In this article, we'll delve into the 5 best branches of banking and finance, highlighting their unique characteristics, benefits, and requirements.

The banking and finance sector is a significant contributor to the global economy, providing essential services such as money management, investment, and credit. With the rise of digital banking and financial technology, the industry has undergone significant transformations, creating new opportunities and challenges for professionals and businesses alike. As we navigate this ever-changing landscape, it's crucial to understand the various branches that make up the banking and finance sector.

From retail banking to investment banking, each branch has its own set of responsibilities, requirements, and benefits. Whether you're interested in working with individual clients, managing large investments, or analyzing financial data, there's a branch that suits your skills and interests. In the following sections, we'll explore the 5 best branches of banking and finance, providing insights into their workings, advantages, and career prospects.

Introduction to Banking Branches

The banking sector is comprised of several branches, each catering to specific needs and goals. These branches include retail banking, corporate banking, investment banking, private banking, and central banking. Each branch has its unique characteristics, benefits, and requirements, making it essential to understand their differences and similarities.

Understanding the Different Branches

The different branches of banking and finance can be categorized based on their functions, services, and target markets. For instance, retail banking focuses on individual clients, providing services such as account management, loans, and credit cards. Corporate banking, on the other hand, caters to businesses, offering services such as cash management, trade finance, and mergers and acquisitions.Branch 1: Retail Banking

Retail banking is one of the most common branches of banking, focusing on individual clients and providing essential services such as account management, loans, and credit cards. Retail banks cater to the financial needs of individuals, offering a range of products and services that enable them to manage their finances effectively. Some of the key services offered by retail banks include:

- Account management: Retail banks provide individuals with various types of accounts, such as checking, savings, and deposit accounts.

- Loans: Retail banks offer loans to individuals for various purposes, such as buying a home, financing a car, or covering unexpected expenses.

- Credit cards: Retail banks issue credit cards, enabling individuals to make purchases and pay for services online or offline.

Benefits of Retail Banking

Retail banking offers several benefits to individuals, including convenience, accessibility, and flexibility. With retail banking, individuals can manage their finances from anywhere, at any time, using online banking services or mobile apps. Additionally, retail banks offer a range of products and services that cater to different financial needs and goals.Branch 2: Corporate Banking

Corporate banking is another significant branch of banking, focusing on businesses and providing services such as cash management, trade finance, and mergers and acquisitions. Corporate banks cater to the financial needs of businesses, offering a range of products and services that enable them to manage their finances effectively. Some of the key services offered by corporate banks include:

- Cash management: Corporate banks provide businesses with cash management services, enabling them to manage their cash flows and liquidity.

- Trade finance: Corporate banks offer trade finance services, enabling businesses to finance their international trade activities.

- Mergers and acquisitions: Corporate banks provide advisory services to businesses, helping them to navigate mergers and acquisitions.

Benefits of Corporate Banking

Corporate banking offers several benefits to businesses, including access to capital, risk management, and financial expertise. With corporate banking, businesses can access a range of financial products and services that enable them to manage their finances effectively and achieve their goals.Branch 3: Investment Banking

Investment banking is a specialized branch of banking, focusing on investment services such as advisory, underwriting, and trading. Investment banks cater to the financial needs of businesses, governments, and institutions, offering a range of products and services that enable them to raise capital, manage risk, and achieve their goals. Some of the key services offered by investment banks include:

- Advisory services: Investment banks provide advisory services to businesses, governments, and institutions, helping them to navigate complex financial transactions.

- Underwriting: Investment banks underwrite securities, enabling businesses and governments to raise capital from investors.

- Trading: Investment banks engage in trading activities, buying and selling securities on behalf of their clients.

Benefits of Investment Banking

Investment banking offers several benefits to businesses, governments, and institutions, including access to capital, risk management, and financial expertise. With investment banking, clients can access a range of financial products and services that enable them to achieve their goals and manage their finances effectively.Branch 4: Private Banking

Private banking is a specialized branch of banking, focusing on high-net-worth individuals and providing services such as wealth management, investment advice, and tax planning. Private banks cater to the financial needs of affluent individuals, offering a range of products and services that enable them to manage their wealth effectively. Some of the key services offered by private banks include:

- Wealth management: Private banks provide wealth management services, enabling high-net-worth individuals to manage their wealth and achieve their financial goals.

- Investment advice: Private banks offer investment advice to high-net-worth individuals, helping them to make informed investment decisions.

- Tax planning: Private banks provide tax planning services, enabling high-net-worth individuals to minimize their tax liabilities and optimize their financial returns.

Benefits of Private Banking

Private banking offers several benefits to high-net-worth individuals, including personalized service, investment expertise, and tax efficiency. With private banking, clients can access a range of financial products and services that enable them to manage their wealth effectively and achieve their financial goals.Branch 5: Central Banking

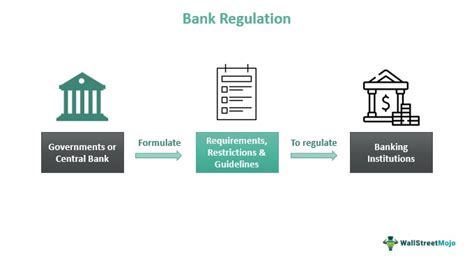

Central banking is a critical branch of banking, focusing on monetary policy, banking regulation, and financial stability. Central banks cater to the financial needs of a country, offering a range of products and services that enable them to manage their finances effectively. Some of the key services offered by central banks include:

- Monetary policy: Central banks implement monetary policy, setting interest rates and regulating the money supply to achieve economic stability.

- Banking regulation: Central banks regulate the banking sector, ensuring that banks operate safely and soundly.

- Financial stability: Central banks work to maintain financial stability, preventing crises and promoting economic growth.

Benefits of Central Banking

Central banking offers several benefits to a country, including economic stability, financial stability, and monetary policy independence. With central banking, a country can manage its finances effectively, regulate its banking sector, and maintain economic stability.Banking Branches Image Gallery

What are the different branches of banking?

+The different branches of banking include retail banking, corporate banking, investment banking, private banking, and central banking.

What services do retail banks offer?

+Retail banks offer services such as account management, loans, and credit cards to individual clients.

What is the role of central banking?

+Central banking plays a critical role in maintaining economic stability, regulating the banking sector, and implementing monetary policy.

What are the benefits of private banking?

+Private banking offers benefits such as personalized service, investment expertise, and tax efficiency to high-net-worth individuals.

What is the difference between retail banking and corporate banking?

+Retail banking focuses on individual clients, while corporate banking caters to the financial needs of businesses.

In conclusion, the 5 best branches of banking and finance offer a range of services and products that cater to different financial needs and goals. Whether you're an individual looking to manage your finances, a business seeking to access capital, or a high-net-worth individual requiring wealth management services, there's a branch that suits your requirements. By understanding the different branches of banking and finance, you can make informed decisions about your financial needs and goals, and navigate the complex world of banking and finance with confidence. We invite you to share your thoughts and experiences with us, and to explore the various branches of banking and finance in more depth.