Intro

Master Military Finance Essentials, including budgeting, saving, and investing strategies, to achieve financial stability and security, with expert advice on military loans, credit scores, and veteran benefits.

The world of military finance can be complex and overwhelming, especially for those who are new to the armed forces. Understanding the basics of military finance is crucial for service members to manage their finances effectively, achieve financial stability, and secure their financial future. In this article, we will delve into the essential aspects of military finance, exploring the benefits, challenges, and best practices for managing your finances as a service member.

Military finance encompasses a wide range of topics, including budgeting, saving, investing, and managing debt. It is essential for service members to have a solid understanding of these concepts to make informed financial decisions. Moreover, the unique aspects of military life, such as frequent deployments, relocations, and variable income, require specialized financial planning. By grasping the fundamentals of military finance, service members can navigate these challenges with confidence and achieve long-term financial success.

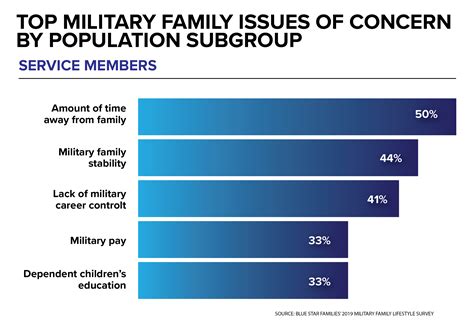

The importance of military finance cannot be overstated. Financial stress can have a significant impact on a service member's mental and emotional well-being, affecting their performance, relationships, and overall quality of life. Furthermore, financial instability can compromise a service member's security clearance, limit their career advancement opportunities, and even affect their ability to deploy. By prioritizing financial education and planning, service members can mitigate these risks and ensure a stable financial foundation for themselves and their families.

Military Finance Benefits

Some of the key military finance benefits include:

- Basic Allowance for Housing (BAH): a tax-free monthly stipend to help cover housing costs

- Basic Allowance for Subsistence (BAS): a tax-free monthly stipend to help cover food costs

- Thrift Savings Plan (TSP): a retirement savings plan with matching contributions from the government

- GI Bill: education assistance for service members and their families

- Military Savings Plans: tax-advantaged savings plans for service members and their families

Military Budgeting and Saving

Some tips for military budgeting and saving include:

- Start with a budget: track your income and expenses to understand where your money is going

- Prioritize needs over wants: distinguish between essential expenses and discretionary spending

- Save automatically: set up automatic transfers to your savings or investment accounts

- Take advantage of tax-advantaged savings plans: utilize plans like the TSP or Military Savings Plans to save for retirement or other goals

Military Investing and Retirement

Some tips for military investing and retirement include:

- Start early: begin saving and investing as soon as possible to take advantage of compound interest

- Diversify your portfolio: spread your investments across different asset classes to minimize risk

- Take advantage of matching contributions: contribute to the TSP or other retirement plans to maximize matching contributions from the government

- Consider professional advice: consult with a financial advisor to create a personalized investment and retirement plan

Military Debt Management

Some tips for military debt management include:

- Prioritize high-interest debt: focus on paying off debt with the highest interest rates first

- Consider debt consolidation: consolidate multiple debts into a single loan with a lower interest rate

- Take advantage of debt forgiveness programs: explore programs like the Public Service Loan Forgiveness (PSLF) program for student loan debt

- Seek professional help: consult with a financial advisor or credit counselor to create a personalized debt management plan

Military Finance Resources

Some military finance resources include:

- Military OneSource: a comprehensive resource for military finance, including financial counseling and education

- Financial Counseling Services: free or low-cost financial counseling services for service members and their families

- Military Financial Readiness Program: a program offering financial education and resources for service members

- National Foundation for Credit Counseling: a non-profit organization providing financial education and credit counseling services

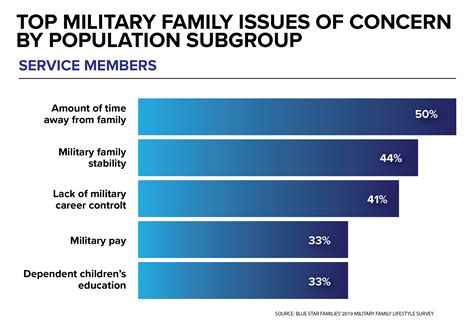

Military Finance Challenges

Some tips for overcoming military finance challenges include:

- Create a budget: track your income and expenses to understand where your money is going

- Prioritize needs over wants: distinguish between essential expenses and discretionary spending

- Save automatically: set up automatic transfers to your savings or investment accounts

- Seek professional help: consult with a financial advisor or credit counselor to create a personalized financial plan

Gallery of Military Finance Images

Military Finance Image Gallery

What are the benefits of military finance?

+The benefits of military finance include competitive pay, comprehensive health insurance, retirement plans, and education assistance. Service members can also take advantage of tax-free housing allowances, food stipends, and other forms of compensation.

How can I create a budget as a service member?

+To create a budget as a service member, start by tracking your income and expenses to understand where your money is going. Prioritize needs over wants, and save automatically by setting up automatic transfers to your savings or investment accounts.

What are some tips for military investing and retirement?

+Some tips for military investing and retirement include starting early, diversifying your portfolio, and taking advantage of matching contributions. Consider professional advice from a financial advisor to create a personalized investment and retirement plan.

In conclusion, military finance is a complex and multifaceted topic that requires careful planning and management. By understanding the benefits, challenges, and best practices for military finance, service members can achieve financial stability, secure their financial future, and enjoy a successful military career. Remember to take advantage of the many resources available, including financial counseling services, online financial education platforms, and mobile apps. With the right knowledge and support, service members can navigate the unique challenges of military finance and achieve long-term financial success. We invite you to share your thoughts and experiences with military finance in the comments below, and don't forget to share this article with your fellow service members and friends.