Intro

Discover top paying branches in high-demand fields like finance, engineering, and technology, offering lucrative career paths and competitive salaries with related fields such as management and computing.

The world of finance and banking is vast and diverse, offering a multitude of career paths for individuals with varying skills and interests. Among the numerous branches of finance, some stand out for their high earning potential, making them particularly attractive to those seeking lucrative careers. Understanding the top paying branches in finance can help aspiring professionals make informed decisions about their career trajectories.

The financial sector is constantly evolving, with new technologies, regulations, and market trends emerging regularly. This dynamic environment creates a high demand for skilled and adaptable professionals who can navigate these changes effectively. As a result, careers in finance are not only financially rewarding but also challenging and engaging, offering opportunities for growth and specialization.

For individuals considering a career in finance, it's essential to explore the various branches that offer high salaries and strong growth prospects. From investment banking to asset management, each branch has its unique characteristics, requirements, and opportunities. By delving into the specifics of these top paying branches, aspiring finance professionals can better position themselves for success in this competitive and rewarding field.

Introduction to Top Paying Branches

The top paying branches in finance include investment banking, private equity, hedge funds, asset management, and corporate finance. These areas are known for their high compensation packages, which often include base salaries, bonuses, and other benefits. However, they also require a high level of expertise, long working hours, and a deep understanding of financial markets and instruments.

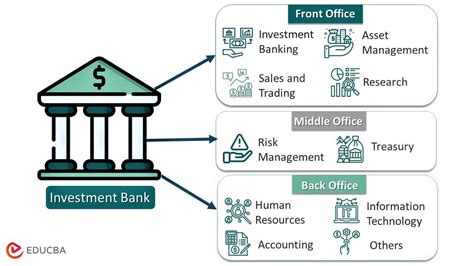

Investment Banking

Investment banking is one of the most lucrative branches of finance, with professionals in this field often earning salaries ranging from $100,000 to over $1 million per year, depending on their position and experience. Investment bankers advise clients on strategic decisions such as mergers and acquisitions, equity and debt financing, and restructuring. They also facilitate these transactions, making investment banking a high-stakes, fast-paced environment.

Roles in Investment Banking

Investment banking encompasses various roles, including: - Analysts: Typically entry-level positions that involve financial modeling, data analysis, and pitch book creation. - Associates: More senior than analysts, associates are involved in deal execution and client management. - Vice Presidents: Oversee deals and manage teams of analysts and associates. - Directors/Managing Directors: Senior leaders who drive business development and strategy.Private Equity

Private equity involves investing in private companies with the aim of eventually selling them for a profit, often through an initial public offering (IPO) or a sale to another company. Professionals in private equity can earn significant amounts, with salaries and carried interest potentially exceeding $500,000 per year for senior roles. Private equity firms look for individuals with strong financial analysis skills, industry knowledge, and the ability to identify and execute profitable investments.

Private Equity Investment Process

The private equity investment process includes: 1. **Fundraising**: Private equity firms raise capital from investors to form a fund. 2. **Deal Sourcing**: Identifying potential investment opportunities. 3. **Due Diligence**: Conducting thorough analysis of the target company. 4. **Investment**: Acquiring the company. 5. **Value Creation**: Implementing strategies to increase the company's value. 6. **Exit**: Selling the company for a profit.Hedge Funds

Hedge funds are investment vehicles that pool funds from high net worth individuals and institutional investors to invest in a variety of assets, with the goal of generating high returns. Hedge fund managers and analysts can earn substantial incomes, often in the form of a percentage of the fund's assets under management (AUM) and a percentage of the profits. This performance-based compensation structure means that successful hedge fund professionals can earn tens of millions of dollars per year.

Hedge Fund Strategies

Hedge funds employ various strategies, including: - **Equity Long/Short**: Betting on the rise of some stocks and the fall of others. - **Global Macro**: Making bets on the direction of macroeconomic trends. - **Event-Driven**: Focusing on companies undergoing significant events like mergers or bankruptcies. - **Activist Investing**: Taking an active role in managing the companies they invest in.Asset Management

Asset management involves managing investments on behalf of individuals, companies, and institutions. Asset managers can work for banks, investment firms, or as independent advisors. Their compensation can be significant, especially for those managing large portfolios or achieving high returns. Asset management encompasses a broad range of investment products, including mutual funds, exchange-traded funds (ETFs), and separately managed accounts.

Types of Asset Management

- **Discretionary Asset Management**: The asset manager makes all investment decisions. - **Non-Discretionary Asset Management**: The client makes the final investment decisions based on advice from the asset manager. - **Robo-Advisory**: Automated investment platforms with little to no human supervision.Corporate Finance

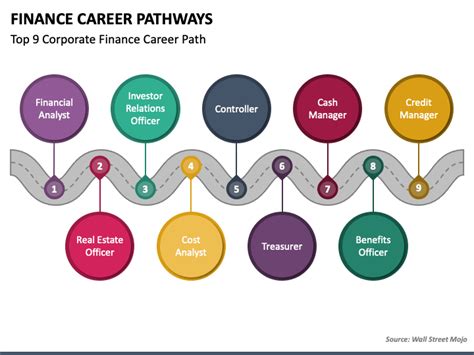

Corporate finance deals with the financial activities related to running a corporation, such as funding, investments, and managing risk. Professionals in corporate finance, such as chief financial officers (CFOs) and financial planners, play critical roles in ensuring the financial health and success of their companies. While salaries may not be as high as in investment banking or private equity, corporate finance roles offer stability and the opportunity to contribute strategically to a company's growth.

Corporate Finance Functions

- **Capital Budgeting**: Deciding on investments and projects. - **Capital Raising**: Securing funding through debt or equity. - **Risk Management**: Identifying and mitigating financial risks. - **Financial Reporting**: Preparing and disclosing financial information.Finance Career Paths Image Gallery

What are the top paying branches in finance?

+The top paying branches in finance include investment banking, private equity, hedge funds, asset management, and corporate finance. These areas are known for offering high compensation packages, including base salaries, bonuses, and other benefits.

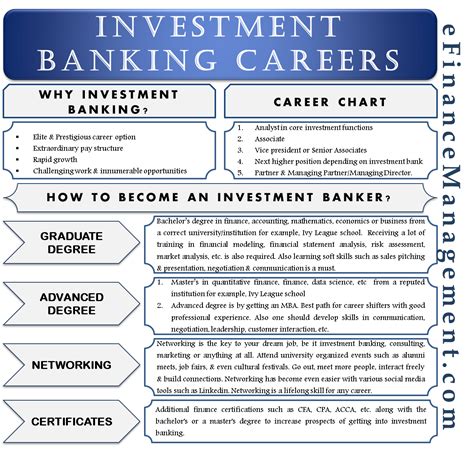

How do I get into investment banking?

+To get into investment banking, you typically need a bachelor's degree in a relevant field like finance, economics, or business. Internships and networking are crucial for securing entry-level positions. Advanced degrees like MBAs can also be beneficial for more senior roles.

What skills are required for a career in private equity?

+Careers in private equity require strong financial analysis skills, industry knowledge, and the ability to identify and execute profitable investments. Professionals in this field must also possess excellent communication and negotiation skills, as they work closely with companies and investors.

How does asset management differ from investment banking?

+Asset management involves managing investments on behalf of clients, whereas investment banking focuses on advising clients on strategic financial decisions and facilitating transactions like mergers and acquisitions. While both fields deal with investments, their approaches, roles, and compensation structures differ significantly.

What is the role of a CFO in corporate finance?

+A Chief Financial Officer (CFO) is responsible for overseeing all financial aspects of a company, including financial planning, risk management, and financial reporting. The CFO plays a critical role in strategic decision-making, ensuring the company's financial health and stability.

In conclusion, the top paying branches in finance offer lucrative career paths for individuals with the right skills, knowledge, and dedication. Whether in investment banking, private equity, hedge funds, asset management, or corporate finance, professionals in these fields have the potential to earn high salaries and bonuses, making them among the most sought-after careers in the financial sector. As the financial industry continues to evolve, understanding these top paying branches and their requirements can help aspiring professionals navigate their career choices effectively. We invite readers to share their thoughts on the most appealing aspects of these finance careers and to explore the various paths that can lead to success in this dynamic and rewarding field.