Intro

Boost investing success with 5 Vanguard UK tips, including fund selection, dividend investing, and portfolio management, to optimize investment strategies and maximize returns.

Investing in the stock market can be a daunting task, especially for those who are new to the world of finance. However, with the right guidance and strategies, anyone can navigate the market and make informed decisions. Vanguard UK is a popular investment platform that offers a wide range of products and services to help individuals achieve their financial goals. In this article, we will provide 5 Vanguard UK tips to help you get the most out of your investments.

The importance of investing in the stock market cannot be overstated. Not only can it provide a potential source of passive income, but it can also help to grow your wealth over time. However, it's essential to approach investing with a clear understanding of the risks and rewards involved. By doing your research and seeking professional advice, you can make informed decisions that align with your financial goals and risk tolerance.

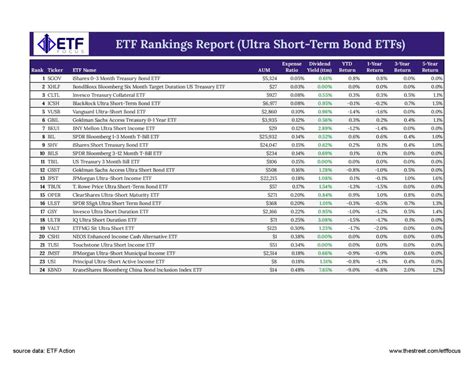

Investing in the stock market can seem complex, but it doesn't have to be. With the right strategies and tools, anyone can start investing and achieving their financial goals. Vanguard UK is a reputable and trustworthy platform that offers a wide range of investment products and services. From index funds to ETFs, Vanguard UK provides a diverse range of options to suit different investment styles and goals.

Understanding Vanguard UK Investment Options

Benefits of Index Funds

Index funds are a popular choice among investors due to their potential benefits, including: * Lower costs: Index funds typically have lower fees compared to actively managed funds. * Diversification: Index funds provide broad diversification by tracking a specific market index. * Consistency: Index funds tend to be less volatile than actively managed funds. * Transparency: Index funds are transparent, making it easy to see what you own.Setting Investment Goals

Assessing Risk Tolerance

Assessing your risk tolerance is crucial when investing in the stock market. Consider the following factors: * Your age: If you're younger, you may be able to take on more risk. * Your financial situation: If you have a stable income and emergency fund, you may be able to take on more risk. * Your investment goals: If you're saving for a short-term goal, you may want to take on less risk.Creating a Diversified Portfolio

Benefits of Diversification

Diversification can provide several benefits, including: * Reduced risk: By spreading your investments across different asset classes and sectors, you can reduce your risk. * Increased potential returns: Diversification can help you capture potential returns from different asset classes and sectors. * Improved stability: A diversified portfolio can be less volatile than a portfolio that is concentrated in a single asset class or sector.Monitoring and Adjusting Your Portfolio

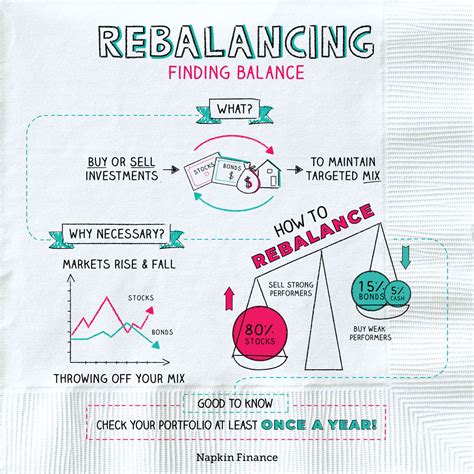

Rebalancing Your Portfolio

Rebalancing your portfolio involves selling investments that have performed well and buying investments that have underperformed. This can help you maintain an optimal asset allocation and manage risk. Consider rebalancing your portfolio: * Quarterly: Rebalance your portfolio every quarter to ensure that it remains aligned with your investment goals and risk tolerance. * Annually: Rebalance your portfolio annually to review your investment goals and risk tolerance and make any necessary adjustments.Using Tax-Efficient Investing Strategies

Vanguard UK Investment Gallery

What is the minimum investment required for Vanguard UK?

+The minimum investment required for Vanguard UK varies depending on the investment product. Some products have a minimum investment of £100, while others have a minimum investment of £1,000.

How do I open a Vanguard UK account?

+To open a Vanguard UK account, you can visit the Vanguard UK website and follow the online application process. You will need to provide personal and financial information, as well as verify your identity.

Can I withdraw my money from Vanguard UK at any time?

+Yes, you can withdraw your money from Vanguard UK at any time. However, you may be subject to certain fees or penalties, depending on the investment product and the terms of your account.

Is Vanguard UK a reputable and trustworthy investment platform?

+Yes, Vanguard UK is a reputable and trustworthy investment platform. Vanguard UK is a well-established and respected investment company with a long history of providing high-quality investment products and services.

How do I contact Vanguard UK customer support?

+You can contact Vanguard UK customer support by phone, email, or online chat. Vanguard UK also has a comprehensive FAQ section on its website, which provides answers to many common questions.

In conclusion, investing in Vanguard UK can be a great way to achieve your financial goals. By following these 5 tips, you can make the most of your investments and maximize your returns. Remember to always do your research, set clear investment goals, and diversify your portfolio to manage risk. With the right strategies and tools, you can navigate the world of investing with confidence and achieve financial success. We encourage you to share your thoughts and experiences with Vanguard UK in the comments below and to share this article with anyone who may be interested in learning more about investing in the stock market.