Intro

Discover 5 ways to calculate pay, including salary, hourly wage, and commission. Learn pay calculation methods, payroll processing, and compensation techniques.

Calculating pay can be a complex process, involving various factors such as hourly wages, salary, commissions, and benefits. Understanding the different methods of calculating pay is essential for both employers and employees to ensure fair compensation and compliance with labor laws. In this article, we will explore five ways to calculate pay, highlighting the benefits and drawbacks of each method.

The importance of accurate pay calculation cannot be overstated. It not only affects the financial well-being of employees but also impacts the overall productivity and morale of the workforce. Employers who fail to calculate pay correctly may face legal repercussions, damage to their reputation, and increased employee turnover. On the other hand, employees who are paid fairly and on time are more likely to be motivated, engaged, and committed to their work.

As the job market continues to evolve, the need for flexible and adaptable pay calculation methods has become increasingly important. With the rise of the gig economy, remote work, and non-traditional employment arrangements, employers must be able to calculate pay in a way that reflects the unique needs and circumstances of their employees. Whether you are an employer looking to optimize your payroll processes or an employee seeking to understand your compensation package, this article will provide you with a comprehensive guide to calculating pay.

Introduction to Pay Calculation Methods

There are several ways to calculate pay, each with its own advantages and disadvantages. The most common methods include hourly wage calculation, salary calculation, commission-based calculation, piece-rate calculation, and hybrid calculation. Understanding the differences between these methods is crucial for employers and employees to navigate the complexities of pay calculation.

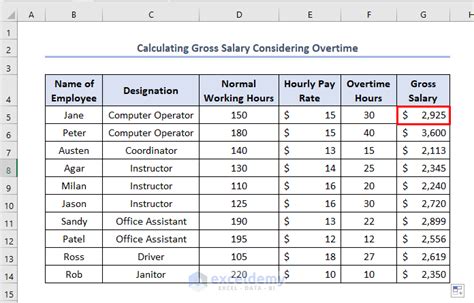

Hourly Wage Calculation

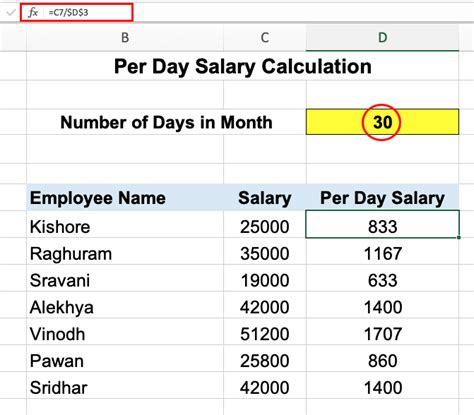

Hourly wage calculation is one of the most common methods of calculating pay. This method involves paying employees an hourly rate for each hour worked. The hourly rate is typically determined by the employer, based on factors such as the employee's job title, experience, and industry standards. To calculate pay using the hourly wage method, employers multiply the hourly rate by the number of hours worked.

For example, if an employee earns $20 per hour and works 40 hours per week, their weekly pay would be $800. This method is often used for part-time or temporary employees, as it provides a clear and transparent way of calculating pay.

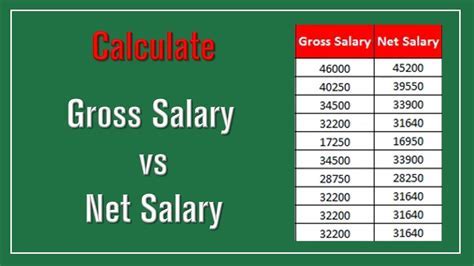

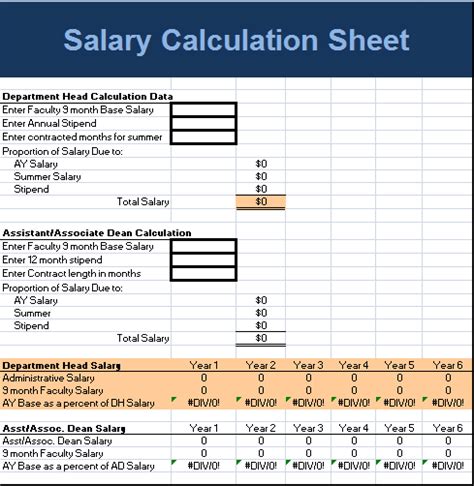

Salary Calculation

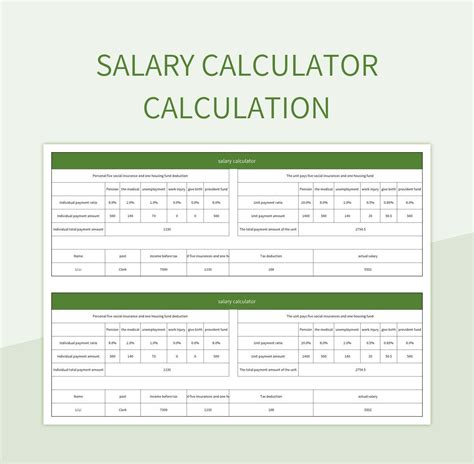

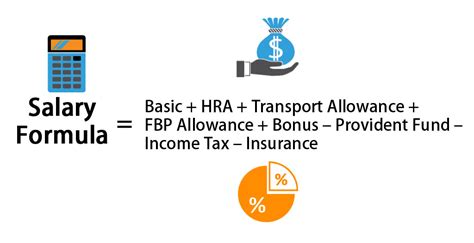

Salary calculation is another common method of calculating pay. This method involves paying employees a fixed annual salary, which is typically divided into regular pay periods such as biweekly or monthly. The salary is often determined by the employer, based on factors such as the employee's job title, experience, and industry standards.

To calculate pay using the salary method, employers divide the annual salary by the number of pay periods. For example, if an employee earns an annual salary of $50,000 and is paid biweekly, their biweekly pay would be $1,923.08.

Commission-Based Calculation

Commission-based calculation is a method of calculating pay that is often used for sales employees. This method involves paying employees a percentage of their sales or revenue generated. The commission rate is typically determined by the employer, based on factors such as the employee's job title, experience, and industry standards.

To calculate pay using the commission-based method, employers multiply the sales or revenue generated by the commission rate. For example, if an employee earns a 10% commission on sales and generates $10,000 in sales, their commission would be $1,000.

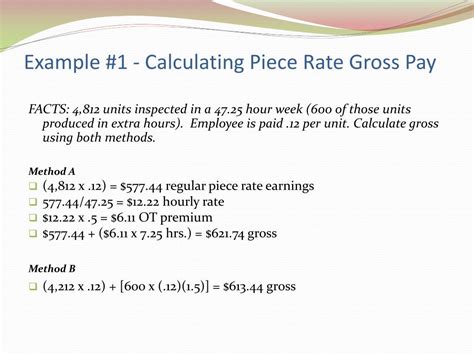

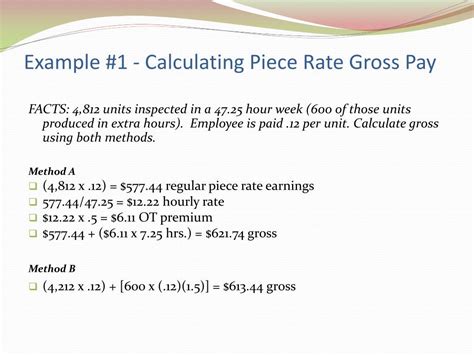

Piece-Rate Calculation

Piece-rate calculation is a method of calculating pay that is often used for employees who produce goods or complete tasks. This method involves paying employees a fixed rate for each unit produced or task completed. The piece rate is typically determined by the employer, based on factors such as the employee's job title, experience, and industry standards.

To calculate pay using the piece-rate method, employers multiply the number of units produced or tasks completed by the piece rate. For example, if an employee earns $5 per unit produced and produces 100 units, their pay would be $500.

Hybrid Calculation

Hybrid calculation is a method of calculating pay that combines two or more of the methods mentioned above. This method involves paying employees a combination of hourly wage, salary, commission, or piece rate. The hybrid method is often used for employees who have multiple roles or responsibilities.

To calculate pay using the hybrid method, employers combine the different pay rates and calculate the total pay. For example, if an employee earns an hourly wage of $20 per hour and a commission of 10% on sales, their total pay would be the sum of their hourly wage and commission.

Benefits of Accurate Pay Calculation

Accurate pay calculation is essential for both employers and employees. It ensures that employees are paid fairly and on time, which can improve morale, productivity, and job satisfaction. Accurate pay calculation also helps employers to avoid legal repercussions, such as fines and penalties, for non-compliance with labor laws.

In addition, accurate pay calculation can help employers to optimize their payroll processes, reduce errors, and improve efficiency. It can also help employees to budget and plan their finances, which can reduce financial stress and improve overall well-being.

Common Pay Calculation Mistakes

Despite the importance of accurate pay calculation, many employers make mistakes when calculating pay. Common mistakes include:

- Incorrect hourly rates or salaries

- Incorrect calculation of overtime pay

- Failure to deduct taxes and benefits

- Incorrect calculation of commissions or piece rates

- Failure to provide accurate pay stubs or records

These mistakes can result in underpayment or overpayment of employees, which can lead to legal repercussions, financial losses, and damage to the employer's reputation.

Best Practices for Pay Calculation

To avoid mistakes and ensure accurate pay calculation, employers should follow best practices such as:

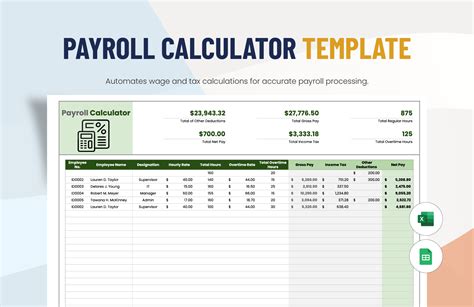

- Using a payroll software or system to automate pay calculation

- Regularly reviewing and updating pay rates and policies

- Providing accurate and timely pay stubs and records

- Conducting regular audits to ensure compliance with labor laws

- Training payroll staff on pay calculation and labor laws

By following these best practices, employers can ensure that their employees are paid fairly and accurately, which can improve morale, productivity, and job satisfaction.

Pay Calculation Image Gallery

What is the most common method of calculating pay?

+The most common method of calculating pay is the hourly wage method, which involves paying employees an hourly rate for each hour worked.

What is the difference between salary and hourly wage calculation?

+Salary calculation involves paying employees a fixed annual salary, which is typically divided into regular pay periods. Hourly wage calculation involves paying employees an hourly rate for each hour worked.

What are the benefits of accurate pay calculation?

+Accurate pay calculation ensures that employees are paid fairly and on time, which can improve morale, productivity, and job satisfaction. It also helps employers to avoid legal repercussions and optimize their payroll processes.

What are the common mistakes made in pay calculation?

+Common mistakes made in pay calculation include incorrect hourly rates or salaries, incorrect calculation of overtime pay, failure to deduct taxes and benefits, and incorrect calculation of commissions or piece rates.

What are the best practices for pay calculation?

+Best practices for pay calculation include using a payroll software or system, regularly reviewing and updating pay rates and policies, providing accurate and timely pay stubs and records, conducting regular audits, and training payroll staff on pay calculation and labor laws.

We hope this article has provided you with a comprehensive guide to calculating pay. Whether you are an employer or employee, understanding the different methods of calculating pay is essential for ensuring fair compensation and compliance with labor laws. By following the best practices outlined in this article, employers can optimize their payroll processes, reduce errors, and improve efficiency. Employees can also benefit from accurate pay calculation, which can improve morale, productivity, and job satisfaction. If you have any further questions or would like to learn more about pay calculation, please don't hesitate to comment or share this article with others.