Intro

Maximize your military compensation with 5 expert pay tips, covering salary, allowances, benefits, and tax breaks to optimize your financial stability and security.

The world of military pay can be complex and overwhelming, especially for those who are new to the armed forces. With various allowances, benefits, and deductions, it's essential to understand how military pay works to make the most of your compensation. In this article, we'll delve into five military pay tips to help you navigate the system and maximize your earnings.

Military pay is a critical aspect of serving in the armed forces, as it provides financial stability and security for service members and their families. However, the pay system can be intricate, with multiple factors influencing take-home pay. By grasping these factors and implementing effective strategies, service members can optimize their financial situation and achieve their long-term goals.

The importance of understanding military pay cannot be overstated. It's crucial for service members to be aware of their pay entitlements, deductions, and benefits to make informed decisions about their finances. Moreover, a comprehensive understanding of military pay can help service members plan for the future, manage debt, and build wealth. In the following sections, we'll explore five military pay tips to help you get the most out of your compensation.

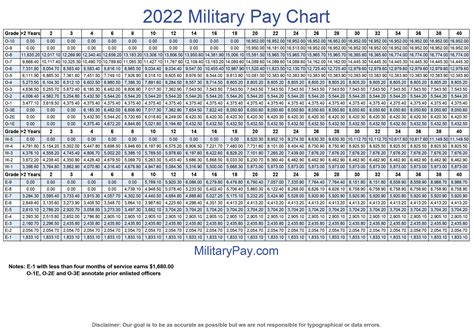

Military Pay Basics

Understanding Pay Grades and Ranks

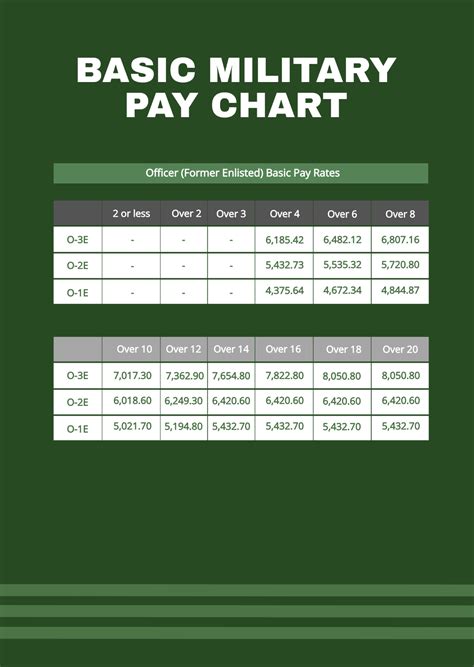

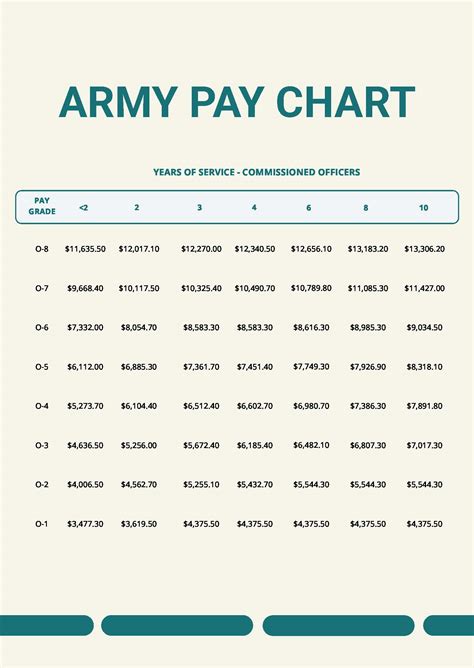

To maximize your military pay, it's crucial to understand the pay grade and rank structure. The military uses a pay grade system, which determines basic pay based on rank and time in service. The pay grades range from E-1 to E-9 for enlisted personnel and O-1 to O-10 for officers. Understanding the pay grade system can help you anticipate pay increases and plan your career accordingly.Tax-Free Benefits

Maximizing Tax-Free Benefits

To maximize tax-free benefits, it's essential to understand which allowances are tax-free and how to claim them. The military provides various tax-free allowances, including the Basic Allowance for Housing (BAH) and the Basic Allowance for Subsistence (BAS). By claiming these allowances, you can reduce your taxable income and increase your take-home pay.Special Pays and Allowances

Qualifying for Special Pays

To qualify for special pays, you must meet specific requirements, such as completing specialized training or serving in a particular duty location. By researching and pursuing special pays, you can increase your earnings and gain a competitive edge in your career.Education Benefits

Using Education Benefits Effectively

To use education benefits effectively, it's essential to understand the different types of benefits available and how to claim them. The GI Bill, for example, provides up to 36 months of education benefits, while tuition assistance covers up to 100% of tuition costs. By leveraging education benefits, you can pursue higher education and achieve your long-term goals.Financial Planning and Budgeting

Creating a Budget

To create a budget, it's essential to track your income and expenses, identify areas for reduction, and prioritize your spending. By using the 50/30/20 rule, which allocates 50% of your income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment, you can create a balanced budget and achieve financial stability.Military Pay Image Gallery

What is the difference between basic pay and special pays?

+Basic pay is the primary component of military pay, while special pays are additional forms of compensation for specific duties or qualifications.

How do I qualify for tax-free benefits?

+To qualify for tax-free benefits, you must meet specific requirements, such as serving in a particular duty location or receiving certain allowances.

What are the different types of education benefits available to military personnel?

+The military offers various education benefits, including the GI Bill and tuition assistance, to help service members pursue higher education and advance their careers.

How can I create a budget and prioritize my expenses?

+To create a budget, track your income and expenses, identify areas for reduction, and prioritize your spending using the 50/30/20 rule.

What resources are available to help military personnel manage their finances?

+Various resources are available, including financial counseling services, online budgeting tools, and military financial websites, to help service members manage their finances effectively.

In conclusion, understanding military pay is crucial for service members to make the most of their compensation and achieve financial stability. By following the five military pay tips outlined in this article, you can optimize your earnings, reduce financial stress, and achieve your long-term goals. Remember to take advantage of tax-free benefits, pursue special pays and allowances, leverage education benefits, and create a budget to prioritize your expenses. With the right knowledge and strategies, you can navigate the complex world of military pay and secure a brighter financial future. We encourage you to share your thoughts and experiences with military pay in the comments below and explore our other articles for more information on personal finance and career development.