Intro

Maximize your military compensation with 5 expert pay tips, covering salary, allowances, benefits, and tax breaks to optimize your financial stability and security.

Understanding and managing military pay is crucial for service members and their families. It's not just about receiving a paycheck, but also about navigating the complexities of military compensation, benefits, and financial planning. Military pay encompasses a wide range of components, from basic pay to allowances and special pays, each designed to support service members in different aspects of their careers and personal lives.

The importance of grasping military pay cannot be overstated. It affects everything from daily living expenses to long-term financial goals, such as buying a home, funding education, or planning for retirement. Moreover, the unique nature of military service, including deployments, relocations, and the potential for combat, adds layers of complexity to financial planning that civilians may not face. Therefore, having a solid understanding of military pay and how to manage it effectively is essential for financial stability and security.

For those serving in the military, staying informed about pay scales, benefits, and financial management strategies is key. This includes being aware of changes in pay rates, understanding how promotions and time in service affect earnings, and knowing how to leverage benefits like the GI Bill or housing allowances. Moreover, service members must balance their current financial needs with long-term goals, all while navigating the challenges of military life. By doing so, they can make the most of their compensation and set themselves and their families up for financial success.

Understanding Military Pay Basics

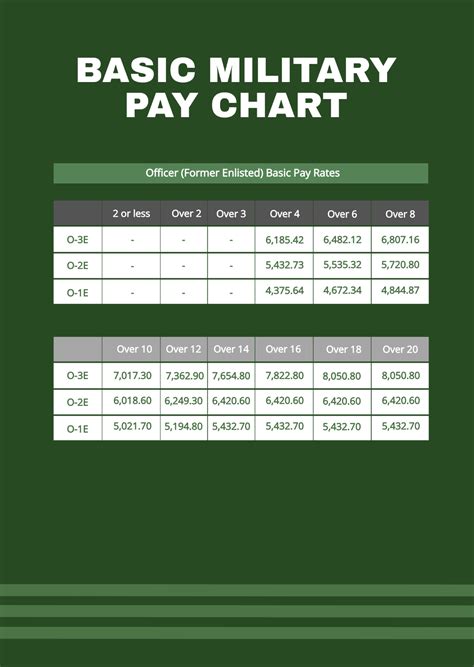

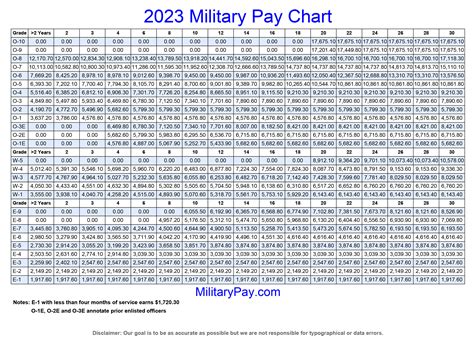

Understanding the basics of military pay is the first step in effective financial management for service members. Military pay is composed of several elements, including basic pay, allowances, and special pays. Basic pay is the primary component and is determined by rank and time in service. Allowances, on the other hand, are provided to help offset specific expenses, such as housing and food, and can vary significantly based on location, family size, and other factors. Special pays are additional forms of compensation for certain duties, skills, or situations, such as hazardous duty pay or combat pay.

Components of Military Pay

The components of military pay can be broken down into the following categories: - Basic Pay: This is the base salary for service members, determined by their rank and time in service. - Allowances: These are provided to help service members pay for certain expenses such as housing (Basic Allowance for Housing, BAH) and food (Basic Allowance for Subsistence, BAS). - Special Pays: These include a variety of additional pays for specific situations or skills, such as flight pay for aviators or hazardous duty pay for those in dangerous assignments. - Bonuses: These are one-time payments for achieving certain milestones, such as reenlisting or entering specific career fields.Managing Military Finances Effectively

Effective financial management is critical for service members to make the most of their military pay and benefits. This involves creating a budget, saving for emergencies, investing for the future, and taking advantage of military-specific financial benefits. Service members should also be aware of the Thrift Savings Plan (TSP), a retirement savings plan similar to a 401(k), and consider contributing to it regularly. Additionally, understanding and leveraging the Servicemembers Civil Relief Act (SCRA), which provides financial protections for active-duty service members, can help mitigate financial stress during deployments or relocations.

Financial Planning Strategies

Some key financial planning strategies for service members include: - Budgeting: Creating a budget that accounts for all income and expenses, including irregular payments like bonuses. - Saving: Building an emergency fund to cover 3-6 months of living expenses in case of unexpected events. - Investing: Utilizing tax-advantaged accounts like the TSP for long-term savings and retirement. - Debt Management: Keeping debt under control, especially high-interest debt, and taking advantage of lower interest rates offered through military credit unions or the SCRA.Military Pay and Benefits for Families

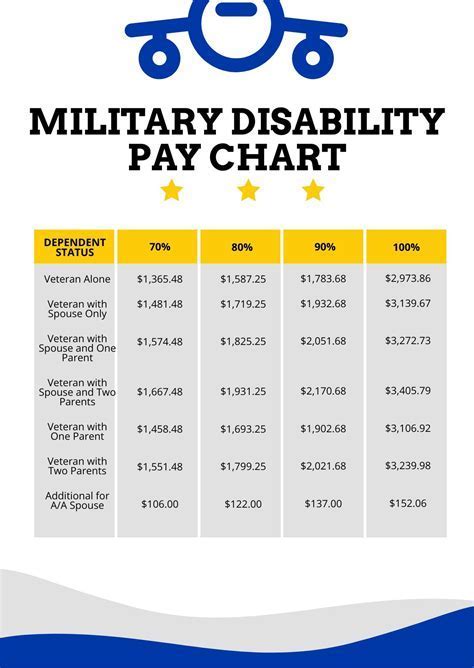

Military pay and benefits are not just limited to the service member; they also extend to their families. Understanding these benefits is crucial for maximizing family financial well-being. The Dependency and Indemnity Compensation (DIC) for spouses and children of service members who die on active duty, education benefits through the GI Bill, and healthcare through TRICARE are just a few examples. Additionally, military families may qualify for housing benefits, food assistance programs, and childcare support, which can significantly impact their quality of life.

Support for Military Families

Some of the key benefits and support available to military families include: - Education Benefits: Using the GI Bill to fund college education or vocational training. - Healthcare: Accessing comprehensive healthcare through TRICARE, including medical, dental, and pharmacy benefits. - Housing Support: Receiving BAH to help offset the cost of housing, or living in base housing. - Childcare Assistance: Utilizing on-base childcare facilities or receiving subsidies for off-base care.Navigating Military Pay Changes and Updates

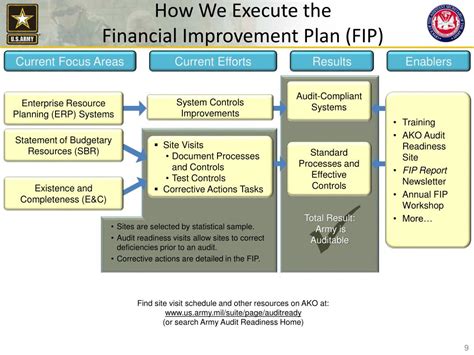

The military pay system is subject to changes and updates, which can affect service members' compensation and benefits. Staying informed about these changes, whether through official military channels, financial advisors, or veteran service organizations, is vital. This includes understanding annual pay rate increases, changes to allowances, and updates to special pays or bonuses. Service members should also be aware of policy changes that could impact their financial planning, such as modifications to the TSP or changes in veteran benefits.

Staying Informed

To stay ahead of changes and updates: - Follow Official Sources: Keep up with announcements from the Department of Defense and service branches. - Consult Financial Advisors: Utilize military financial advisors or veteran service organizations for personalized advice. - Join Veteran Networks: Connect with veteran groups and online forums to share information and experiences.Long-Term Financial Planning for Service Members

Long-term financial planning is essential for service members to achieve their financial goals, whether that's buying a home, funding their children's education, or retiring comfortably. This involves setting clear financial objectives, creating a tailored financial plan, and consistently reviewing and adjusting it as needed. Service members should consider their military career trajectory, potential retirement benefits, and post-service career opportunities when planning for the future.

Retirement Planning

Key aspects of long-term financial planning include: - Retirement Savings: Consistently contributing to the TSP and potentially supplementing with other retirement accounts. - Career Transition: Planning for a post-military career, including education, training, and networking. - Insurance and Benefits: Understanding and leveraging life insurance, disability insurance, and veteran benefits.Utilizing Military Financial Resources

The military and veteran communities offer a wealth of financial resources designed to support service members and their families. These resources range from financial counseling services and education programs to emergency financial assistance and legal aid. Utilizing these resources can provide service members with the tools and knowledge they need to manage their finances effectively, navigate financial challenges, and achieve long-term financial stability.

Available Resources

Some of the key resources include: - Military Financial Counseling: Free, personalized financial counseling through programs like the Military Financial Readiness Program. - Education and Workshops: Financial education classes and workshops offered on bases and through veteran organizations. - Emergency Assistance: Programs that provide emergency financial assistance for needs like food, housing, and utilities.Military Pay and Benefits Image Gallery

What is the difference between basic pay and allowances in the military?

+Basic pay is the base salary for service members, determined by rank and time in service. Allowances, on the other hand, are provided to help offset specific expenses such as housing and food.

How do special pays work in the military?

+Special pays are additional forms of compensation for certain duties, skills, or situations. They can include flight pay, hazardous duty pay, and combat pay, among others, and are intended to recognize and reward service members for their unique contributions and challenges.

What financial resources are available to help military families manage their finances?

+Military families have access to a range of financial resources, including financial counseling services, education programs, emergency financial assistance, and legal aid. These resources are designed to support service members and their families in achieving financial stability and security.

How can service members make the most of their military pay and benefits?

+Service members can make the most of their military pay and benefits by understanding the different components of their compensation, creating a budget, saving for the future, and taking advantage of military-specific financial benefits and resources. Staying informed about changes to pay and benefits is also crucial.

What role does the Thrift Savings Plan play in military retirement planning?

+The Thrift Savings Plan (TSP) is a retirement savings plan for service members and federal employees. It offers a tax-advantaged way to save for retirement and can be a key component of a service member's long-term financial plan, especially when combined with other retirement benefits.

In conclusion, navigating the world of military pay and benefits requires a comprehensive understanding of the various components of compensation, benefits, and financial management strategies. By staying informed, leveraging available resources, and planning carefully, service members and their families can achieve financial stability and security, both during and after their military service. We invite you to share your experiences, ask questions, and seek advice on managing military pay and benefits. Your insights and feedback are invaluable in helping others navigate this complex but rewarding aspect of military life.