Intro

Discover Local 150 Credit Union Services, offering personalized banking, loans, and financial management, with convenient online banking, mobile banking, and member benefits, tailored to support local communities and small businesses with affordable credit union solutions.

As a member of Local 150, you have access to a wide range of benefits and services designed to support your financial well-being. One of the most valuable resources available to you is the Local 150 Credit Union, which offers a variety of financial products and services tailored to meet the unique needs of union members. In this article, we will delve into the world of Local 150 Credit Union services, exploring the benefits, features, and advantages of being a member.

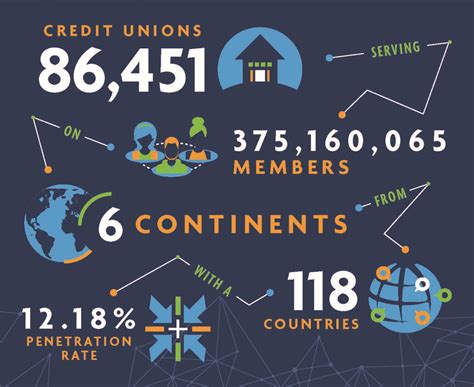

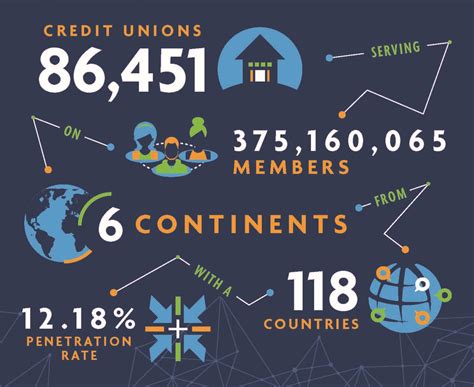

The Local 150 Credit Union is a not-for-profit financial cooperative that is owned and operated by its members. This means that the credit union is dedicated to providing its members with the best possible rates, terms, and services, rather than prioritizing profits for shareholders. By joining the credit union, you can take advantage of a range of financial services, including savings and checking accounts, loans, credit cards, and investment products. Whether you are looking to build your savings, finance a major purchase, or simply manage your day-to-day finances, the Local 150 Credit Union has the tools and expertise to help you achieve your goals.

Benefits of Local 150 Credit Union Membership

Financial Products and Services

Loans and Credit

Investment and Retirement Planning

Financial Education and Counseling

Online and Mobile Banking

Community Involvement

Gallery of Local 150 Credit Union Services

Local 150 Credit Union Services Image Gallery

What are the benefits of joining the Local 150 Credit Union?

+The benefits of joining the Local 150 Credit Union include competitive rates on loans and deposits, low fees, and personalized service. Members also have access to a range of financial products and services, including savings and checking accounts, loans, credit cards, and investment products.

How do I become a member of the Local 150 Credit Union?

+To become a member of the Local 150 Credit Union, you must meet the eligibility requirements, which include being a member of Local 150 or having a family member who is a member. You can apply for membership online or in person at a credit union branch.

What types of loans and credit products are available through the Local 150 Credit Union?

+The Local 150 Credit Union offers a range of loan and credit products, including mortgage loans, auto loans, personal loans, credit cards, and lines of credit. These products are designed to meet the unique needs of union members, with competitive rates, flexible terms, and personalized service.

How can I access my accounts and conduct transactions online or through my mobile device?

+The Local 150 Credit Union offers online and mobile banking services, allowing you to manage your accounts, pay bills, and transfer funds from the convenience of your home or on-the-go. You can access these services through the credit union's website or mobile app.

What types of financial education and counseling resources are available through the Local 150 Credit Union?

+The Local 150 Credit Union offers a range of financial education and counseling resources, including workshops and seminars, one-on-one financial counseling and planning services, and online resources and tools. These resources are designed to help you make informed financial decisions and achieve your long-term goals.

As a member of Local 150, you have access to a wide range of benefits and services designed to support your financial well-being. The Local 150 Credit Union is a valuable resource that can help you achieve your financial goals, with competitive rates, flexible terms, and personalized service. Whether you are looking to build your savings, finance a major purchase, or simply manage your day-to-day finances, the Local 150 Credit Union has the tools and expertise to help you succeed. We invite you to learn more about the credit union and its services, and to take advantage of the many benefits of membership. Share this article with your friends and family, and encourage them to join the Local 150 Credit Union today!