Intro

Master Air Force financial management with our comprehensive guide, covering budgeting, forecasting, and resource allocation, to optimize military finance operations and decision-making.

The Air Force is a complex organization with a wide range of responsibilities, from defending the nation to supporting humanitarian missions. At the heart of these operations is a robust financial management system that ensures the effective allocation and utilization of resources. Financial management in the Air Force is not just about numbers; it's about supporting the mission, enhancing readiness, and making informed decisions that impact the entire organization. In this article, we will delve into the world of Air Force financial management, exploring its principles, processes, and the critical role it plays in supporting the Air Force's objectives.

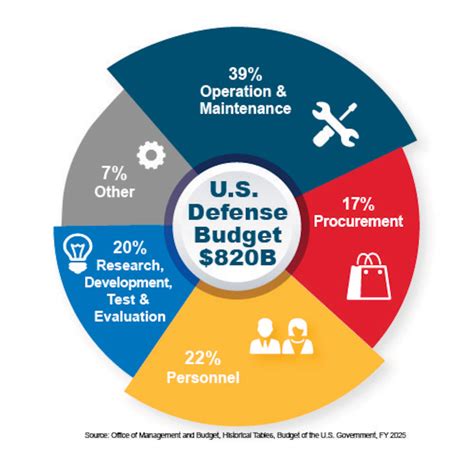

Effective financial management is crucial for the Air Force to achieve its strategic goals. It involves planning, organizing, and controlling financial resources to ensure they are used efficiently and effectively. This encompasses budgeting, forecasting, financial reporting, and internal controls, all of which are designed to promote transparency, accountability, and compliance with regulatory requirements. The Air Force's financial management system must be agile and responsive, capable of adapting to changing operational demands and fiscal environments.

The foundation of Air Force financial management is built on several key principles. First, there is a strong emphasis on stewardship, recognizing that the resources entrusted to the Air Force belong to the American taxpayer. This principle underscores the importance of using resources wisely and efficiently. Second, financial management is integrated into the planning and execution of operations, ensuring that financial considerations are aligned with operational objectives. Third, there is a commitment to transparency and accountability, with robust reporting and auditing processes in place to ensure the proper use of funds.

Air Force Financial Management Structure

The Air Force's financial management structure is designed to support these principles, with clear lines of authority and responsibility. At the top is the Assistant Secretary of the Air Force for Financial Management and Comptroller, who oversees the development and execution of the Air Force budget. Below this level are various financial management offices and agencies, each with specific responsibilities such as budget planning, financial analysis, and auditing. This structure ensures that financial management is both centralized and decentralized, allowing for flexibility and responsiveness at the unit level while maintaining overall coordination and control.

Financial Planning and Budgeting

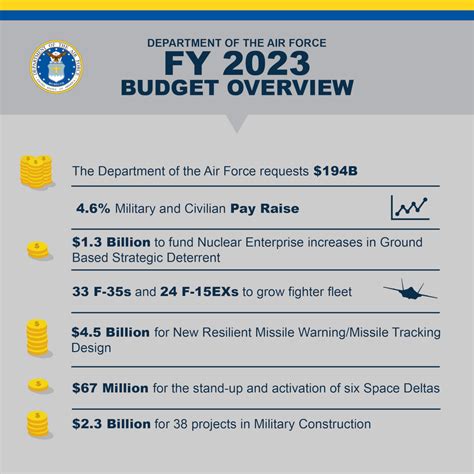

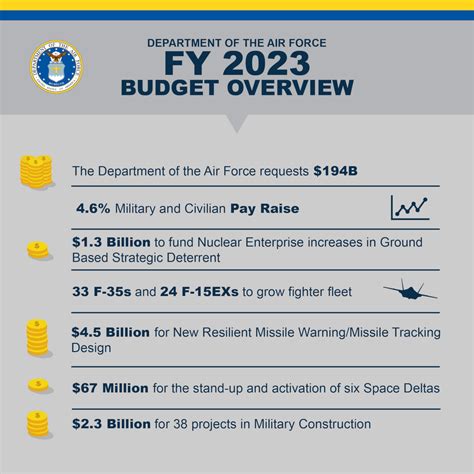

Financial planning and budgeting are core components of Air Force financial management. The budgeting process begins with the development of the Future Years Defense Program (FYDP), a five-year plan that outlines projected funding levels and priorities. This is followed by the preparation of the annual budget, which is submitted to Congress for approval. Once the budget is approved, financial managers at all levels of the Air Force work to execute the budget, ensuring that funds are obligated and expended in accordance with planned priorities. Financial planning also involves forecasting, which helps identify potential funding shortfalls or surpluses and enables proactive measures to be taken.

Key Budgeting Considerations

- Operational Priorities: Budgeting decisions are driven by operational priorities, ensuring that funding supports critical missions and readiness.

- Resource Allocation: Resources are allocated based on a thorough analysis of needs and priorities, with an emphasis on efficiency and effectiveness.

- Financial Flexibility: The budget is designed to provide financial flexibility, allowing for adjustments in response to changing operational demands or fiscal conditions.

Financial Execution and Control

Financial execution and control are critical to ensuring that the Air Force's financial resources are used as intended. This involves a range of activities, from obligating funds for specific purposes to expending those funds in accordance with approved plans. Internal controls play a vital role in this process, providing assurance that transactions are properly authorized, recorded, and reported. The Air Force also employs various financial management systems and tools to support financial execution and control, including the Defense Department's financial management system, which provides real-time data on financial transactions and balances.

Internal Controls and Auditing

- Risk Assessment: Regular risk assessments are conducted to identify potential vulnerabilities in financial processes and controls.

- Control Activities: Control activities, such as approvals and verifications, are implemented to mitigate identified risks.

- Information and Communication: Clear policies and procedures are communicated to all personnel involved in financial management, ensuring they understand their roles and responsibilities.

Financial Reporting and Analysis

Financial reporting and analysis are essential for evaluating the effectiveness of financial management in the Air Force. Regular financial reports provide insights into the status of funds, expenditures, and commitments, helping financial managers identify trends, challenges, and opportunities for improvement. Financial analysis involves examining financial data to assess performance, make predictions, and inform decision-making. This can include analyzing budget variance, return on investment (ROI) for specific programs, and the financial impact of operational decisions.

Financial Metrics and Performance Indicators

- Budget Performance: Actual expenditures are compared against budgeted amounts to assess financial performance.

- Financial Ratios: Financial ratios, such as the current ratio and debt-to-equity ratio, are used to evaluate the Air Force's financial health and stability.

- Return on Investment (ROI): ROI analysis is conducted for major investments to ensure they provide sufficient financial returns.

Challenges and Opportunities

Despite the advancements in Air Force financial management, there are challenges and opportunities that must be addressed. One of the significant challenges is the complexity of the financial management system itself, which can lead to inefficiencies and errors. Another challenge is the need for greater transparency and accountability, particularly in the face of evolving security threats and fiscal constraints. Opportunities for improvement include leveraging technology to enhance financial reporting and analysis, implementing more agile budgeting processes, and developing more sophisticated financial metrics and performance indicators.

Modernizing Financial Management

- Digital Transformation: Embracing digital technologies to automate financial processes, improve data analytics, and enhance decision-making.

- Agile Budgeting: Adopting more flexible and responsive budgeting approaches to better align with changing operational needs.

- Financial Innovation: Exploring innovative financial instruments and strategies to optimize resource allocation and achieve better financial outcomes.

Air Force Financial Management Image Gallery

What are the primary objectives of Air Force financial management?

+The primary objectives of Air Force financial management are to ensure the effective and efficient use of resources, support operational readiness, and promote transparency and accountability in financial operations.

How does the Air Force approach budget planning and execution?

+The Air Force approaches budget planning and execution through a comprehensive process that includes developing a five-year plan, preparing an annual budget, and executing the budget in line with operational priorities and fiscal constraints.

What role does financial analysis play in Air Force decision-making?

+Financial analysis plays a critical role in Air Force decision-making by providing insights into the financial implications of operational decisions, evaluating the effectiveness of resource allocation, and identifying opportunities for cost savings and efficiency improvements.

As we explore the complexities and nuances of Air Force financial management, it becomes clear that this field is not just about managing resources; it's about supporting the mission, enhancing readiness, and ensuring the long-term sustainability of the Air Force. By understanding the principles, processes, and challenges of financial management, we can better appreciate the critical role it plays in the success of the Air Force. Whether you are a financial professional, an operational commander, or simply someone interested in how the Air Force manages its resources, this guide has provided a comprehensive overview of the key aspects of Air Force financial management. We invite you to continue the conversation, share your insights, and explore how together, we can advance the practice of financial management in the Air Force.