Intro

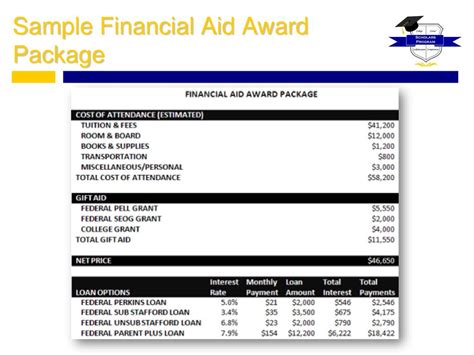

Discover how college financial aid works. Get money for college through scholarships, grants, and loans, and learn about refund checks and tax credits for students and parents.

Pursuing higher education can be a significant investment, and many students wonder if college can actually send them money. The answer is yes, but it's not as straightforward as receiving a check in the mail. Colleges and universities offer various forms of financial assistance to help students cover tuition fees, living expenses, and other education-related costs. In this article, we'll delve into the world of college financial aid and explore the ways in which colleges can send you money.

The importance of financial aid cannot be overstated. With the rising costs of tuition, room, and board, many students struggle to make ends meet. According to the National Center for Education Statistics, the average tuition fee for the 2020-2021 academic year was over $10,000 for in-state students at public four-year colleges. For out-of-state students, this figure jumps to over $26,000. Private non-profit colleges charge even more, with an average tuition fee of over $36,000. It's clear that financial assistance is essential for many students to pursue their academic goals.

Colleges and universities recognize the financial burden that students face, and they offer various forms of aid to help alleviate this burden. From scholarships and grants to loans and work-study programs, there are numerous ways in which colleges can send you money. In the following sections, we'll explore these options in more detail, providing you with a comprehensive understanding of the financial aid landscape.

Types of Financial Aid

- Scholarships: Merit-based or need-based awards that don't require repayment

- Grants: Need-based awards that don't require repayment

- Loans: Federal or private loans that require repayment with interest

- Work-study programs: Part-time jobs that help students earn money for expenses

Each of these options has its own eligibility criteria, application process, and benefits. Understanding the differences between them is crucial to making informed decisions about your financial aid package.

Scholarships and Grants

Scholarships and grants are excellent ways to receive money from colleges without incurring debt. These awards are typically based on academic merit, financial need, or a combination of both. Some scholarships and grants are offered by the college itself, while others are provided by external organizations or government agencies.To increase your chances of receiving a scholarship or grant, it's essential to maintain a strong academic record, demonstrate financial need, and meet the eligibility criteria for each award. Many colleges also offer specialized scholarships for students pursuing specific fields of study, such as STEM or the arts.

Loans and Work-Study Programs

Work-study programs, such as the Federal Work-Study (FWS) program, provide part-time jobs to students, allowing them to earn money for expenses while gaining valuable work experience. These programs are usually need-based and require students to work a certain number of hours per week.

Applying for Financial Aid

To receive financial aid, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is a standardized form that collects information about a student's financial situation, including income, assets, and family size. This information is used to determine the student's Expected Family Contribution (EFC), which is then used to calculate their eligibility for financial aid.The FAFSA is typically available on October 1st of each year, and students should submit their application as early as possible to ensure they receive the maximum amount of aid. Some colleges may also require additional forms or documentation, such as the CSS Profile or tax returns.

Maximizing Your Financial Aid Package

- Complete the FAFSA as early as possible to ensure you receive the maximum amount of aid

- Apply for external scholarships and grants to supplement your college's financial aid package

- Consider taking out federal loans, which offer more favorable interest rates and repayment terms than private loans

- Participate in work-study programs to earn money for expenses while gaining valuable work experience

By following these tips and understanding the different types of financial aid available, you can maximize your financial aid package and reduce your out-of-pocket expenses.

Additional Resources

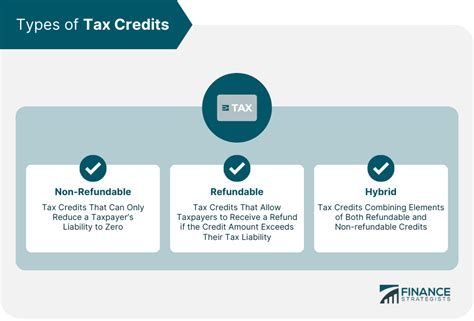

In addition to the financial aid options mentioned above, there are several other resources available to help students cover their expenses. These include:- Tax credits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit

- Education savings plans, such as 529 plans or Coverdell Education Savings Accounts

- Private scholarships and grants, such as those offered by companies or non-profit organizations

These resources can provide additional funding for students and help reduce their reliance on loans and other forms of debt.

Gallery of Financial Aid Options

Financial Aid Image Gallery

Frequently Asked Questions

What is the FAFSA, and how do I complete it?

+The FAFSA is a standardized form that collects information about a student's financial situation. To complete the FAFSA, visit the official FAFSA website and follow the instructions provided.

What types of financial aid are available to college students?

+There are several types of financial aid available to college students, including scholarships, grants, loans, and work-study programs.

How do I maximize my financial aid package?

+To maximize your financial aid package, complete the FAFSA as early as possible, apply for external scholarships and grants, and consider taking out federal loans.

As you can see, colleges can indeed send you money, but it's essential to understand the different types of financial aid available and how to apply for them. By completing the FAFSA, applying for external scholarships and grants, and considering federal loans, you can maximize your financial aid package and reduce your out-of-pocket expenses. Remember to also explore additional resources, such as tax credits and education savings plans, to help fund your college education. Share your thoughts on financial aid and college funding in the comments below, and don't forget to share this article with friends and family who may be navigating the world of college financial aid.