Intro

Discover the difference between Combat Pay and Hazard Pay, including eligibility, benefits, and tax implications for military personnel in high-risk zones, special operations, and hazardous duty assignments.

The terms "combat pay" and "hazard pay" are often used interchangeably, but they have distinct meanings and implications for individuals serving in the military or working in hazardous environments. Understanding the differences between these two types of pay is essential for those who may be eligible to receive them. In this article, we will delve into the world of combat pay and hazard pay, exploring their definitions, eligibility criteria, and the benefits they provide.

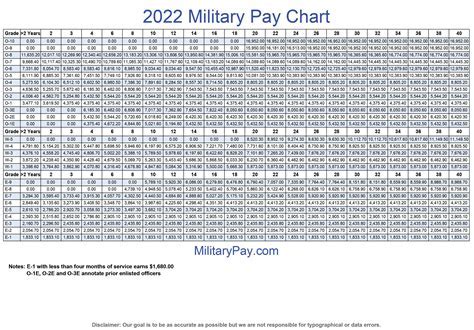

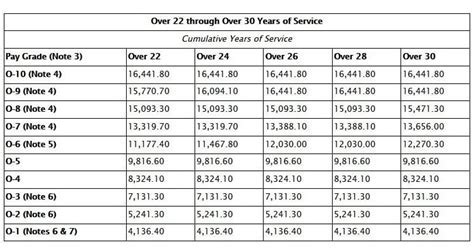

Combat pay, also known as hostile fire pay or imminent danger pay, is a type of special pay given to military personnel who serve in areas where they are exposed to hostile fire or other life-threatening conditions. This pay is intended to compensate service members for the risks they take while serving in combat zones or other hazardous areas. Combat pay is usually paid at a flat rate, and the amount can vary depending on the location and the level of risk involved.

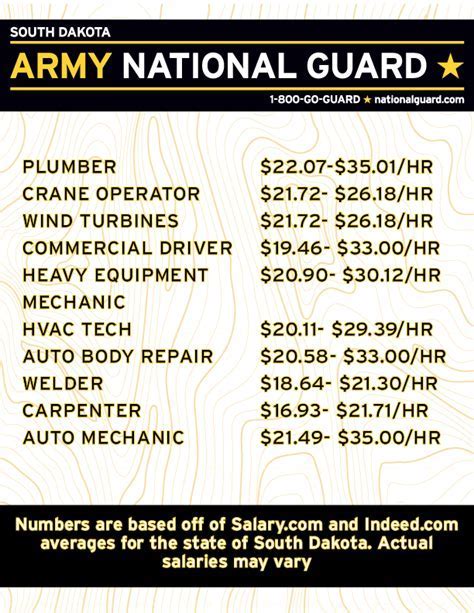

On the other hand, hazard pay is a type of pay that is given to individuals who work in hazardous environments or perform hazardous duties. This pay is intended to compensate workers for the risks they take while performing their jobs, and it can be paid in addition to their regular salary. Hazard pay can be given to a wide range of workers, including military personnel, first responders, and civilians who work in hazardous industries such as construction or manufacturing.

Combat Pay Explained

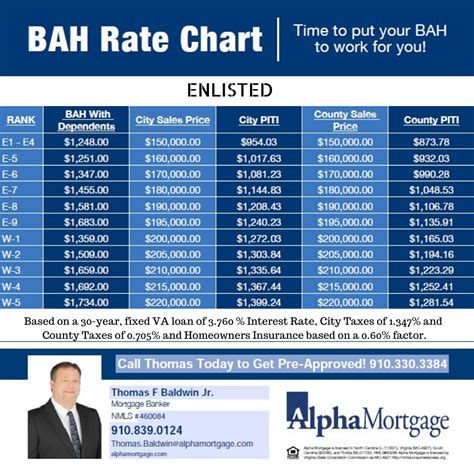

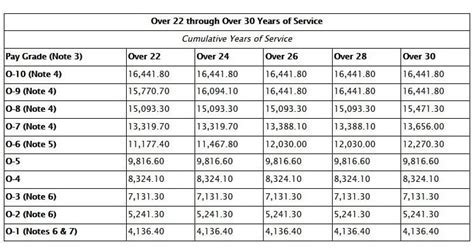

To be eligible for combat pay, service members must meet certain criteria, such as serving in a designated combat zone or performing duties that expose them to hostile fire or other life-threatening conditions. The amount of combat pay that service members receive can vary depending on their rank, time in service, and the location where they are serving.

Types of Combat Pay

There are several types of combat pay, including: * Hostile fire pay: This type of pay is given to service members who serve in areas where they are exposed to hostile fire or other life-threatening conditions. * Imminent danger pay: This type of pay is given to service members who serve in areas where they are at risk of being attacked or injured. * Combat zone tax exclusion: This type of pay is given to service members who serve in combat zones and are exempt from paying taxes on their income.Hazard Pay Explained

To be eligible for hazard pay, workers must meet certain criteria, such as working in a hazardous environment or performing duties that expose them to risks. The amount of hazard pay that workers receive can vary depending on the level of risk involved, their job duties, and the industry they work in.

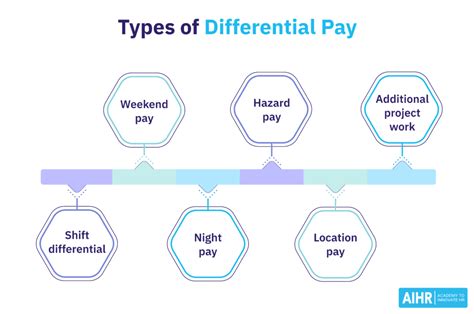

Types of Hazard Pay

There are several types of hazard pay, including: * Environmental hazard pay: This type of pay is given to workers who work in environments that are hazardous to their health, such as areas with high levels of pollution or toxic substances. * Physical hazard pay: This type of pay is given to workers who perform duties that are physically demanding or expose them to physical risks, such as construction or manufacturing work. * Psychological hazard pay: This type of pay is given to workers who perform duties that are emotionally demanding or expose them to psychological risks, such as first responders or social workers.Key Differences Between Combat Pay and Hazard Pay

Another difference is the eligibility criteria. Combat pay is usually only given to military personnel who serve in designated combat zones or perform duties that expose them to hostile fire or other life-threatening conditions. Hazard pay, on the other hand, can be given to a wide range of workers who work in hazardous environments or perform hazardous duties.

Similarities Between Combat Pay and Hazard Pay

Despite the differences between combat pay and hazard pay, there are also several similarities. Both types of pay are intended to compensate individuals for the risks they take, and both can be paid in addition to regular salary. Both combat pay and hazard pay can also be tax-free, depending on the circumstances.Benefits of Combat Pay and Hazard Pay

Another benefit of combat pay and hazard pay is the tax benefits they provide. Both types of pay can be tax-free, depending on the circumstances, which can help to reduce the tax burden on individuals who receive them.

Challenges of Combat Pay and Hazard Pay

While combat pay and hazard pay provide several benefits, there are also several challenges associated with them. One of the main challenges is the eligibility criteria. Combat pay and hazard pay are usually only given to individuals who meet certain criteria, such as serving in a designated combat zone or working in a hazardous environment.Another challenge is the amount of pay that individuals receive. Combat pay and hazard pay can vary widely depending on the circumstances, and individuals may not always receive the amount of pay that they expect.

Combat Pay and Hazard Pay Image Gallery

What is combat pay?

+Combat pay is a type of special pay given to military personnel who serve in areas where they are exposed to hostile fire or other life-threatening conditions.

What is hazard pay?

+Hazard pay is a type of pay that is given to individuals who work in hazardous environments or perform hazardous duties.

What are the benefits of combat pay and hazard pay?

+Both combat pay and hazard pay provide several benefits, including additional income, tax benefits, and compensation for the risks and challenges associated with serving in combat zones or working in hazardous environments.

How do I know if I am eligible for combat pay or hazard pay?

+To determine if you are eligible for combat pay or hazard pay, you should consult with your employer or the relevant military or government agency.

Can I receive both combat pay and hazard pay?

+Yes, it is possible to receive both combat pay and hazard pay, depending on your circumstances and the eligibility criteria for each type of pay.

In conclusion, combat pay and hazard pay are two types of special pay that are given to individuals who serve in combat zones or work in hazardous environments. While both types of pay are intended to compensate individuals for the risks they take, there are several key differences between them. By understanding the differences and benefits of combat pay and hazard pay, individuals can make informed decisions about their careers and financial situations. If you have any further questions or would like to learn more about combat pay and hazard pay, please do not hesitate to comment or share this article with others.