Intro

Boost investment success with 5 Cap Vanguard tips, featuring strategic portfolio management, dividend investing, and long-term wealth creation, optimizing returns and minimizing risk.

The world of investing can be overwhelming, especially for those who are new to the game. With so many options and strategies to choose from, it's easy to feel like you're in over your head. However, with the right guidance and a solid understanding of the basics, anyone can become a successful investor. In this article, we'll be discussing 5 Cap Vanguard tips that can help you make the most of your investments and achieve your long-term financial goals.

Investing in the stock market can be a great way to grow your wealth over time, but it's not without its risks. The key to success lies in finding a balance between risk and reward, and being patient enough to ride out the ups and downs of the market. One of the most popular and successful investment companies out there is Vanguard, known for its low-cost index funds and ETFs. By following these 5 Cap Vanguard tips, you can set yourself up for success and make the most of your investments.

The first step to successful investing is to have a clear understanding of your financial goals and risk tolerance. What are you trying to achieve through your investments? Are you saving for retirement, a down payment on a house, or something else? How much risk are you willing to take on in pursuit of your goals? Once you have a clear understanding of your goals and risk tolerance, you can start to build a portfolio that's tailored to your needs.

Understanding Vanguard's Investment Philosophy

Tip 1: Start with a Solid Foundation

Tip 2: Keep Costs Low

Tip 3: Be Patient and Disciplined

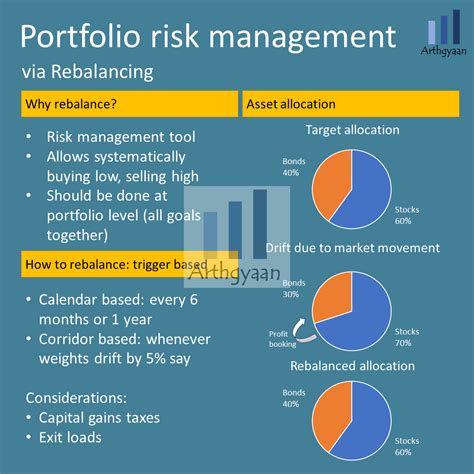

Tip 4: Rebalance Your Portfolio Regularly

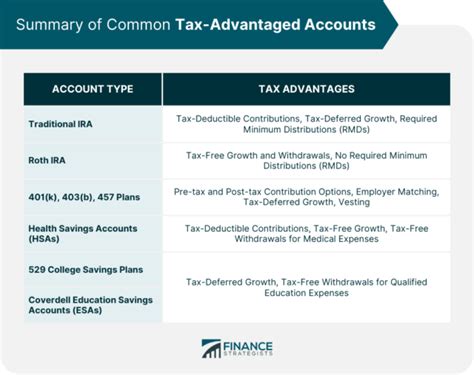

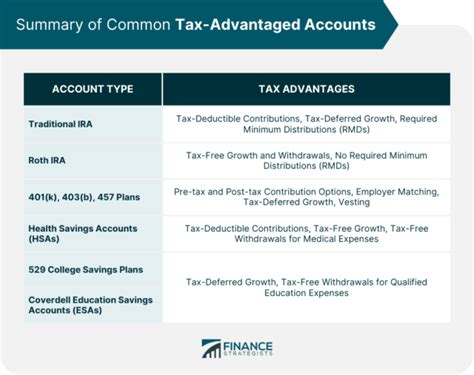

Tip 5: Take Advantage of Tax-Advantaged Accounts

Benefits of Investing with Vanguard

Some of the benefits of investing with Vanguard include: * Low costs: Vanguard is known for its low-cost index funds and ETFs, which can help you to save money on fees and expenses. * Diversification: Vanguard's index funds and ETFs provide broad diversification across a range of asset classes and sectors, which can help you to manage risk and maximize your returns. * Long-term approach: Vanguard's investment philosophy is centered around the idea of long-term investing, which can help you to avoid making emotional decisions based on short-term market fluctuations. * Tax-advantaged accounts: Vanguard offers a range of tax-advantaged accounts, including 401(k)s, IRAs, and Roth IRAs, which can help you to reduce your tax liability and maximize your returns over time.Investment Strategies for Different Risk Tolerances

Common Mistakes to Avoid

Vanguard Investment Gallery

What is the best way to get started with investing in Vanguard?

+The best way to get started with investing in Vanguard is to open an account and start with a solid foundation, such as a total stock market index fund. From there, you can add other funds or ETFs to your portfolio over time, depending on your individual needs and goals.

How do I choose the right investment strategy for my risk tolerance?

+To choose the right investment strategy for your risk tolerance, it's essential to have a clear understanding of your financial goals and risk tolerance. You can then develop an investment strategy that aligns with your individual needs and goals, such as a conservative, moderate, or aggressive approach.

What are the benefits of investing in Vanguard's index funds and ETFs?

+The benefits of investing in Vanguard's index funds and ETFs include low costs, diversification, and a long-term approach. Vanguard's index funds and ETFs provide broad diversification across a range of asset classes and sectors, which can help you to manage risk and maximize your returns over time.

How often should I rebalance my portfolio?

+It's essential to rebalance your portfolio regularly to ensure that your investments remain aligned with your long-term goals and risk tolerance. The frequency of rebalancing will depend on your individual needs and goals, but a common approach is to rebalance your portfolio every 6-12 months.

What are the tax implications of investing in Vanguard's tax-advantaged accounts?

+Vanguard's tax-advantaged accounts, such as 401(k)s, IRAs, and Roth IRAs, can help you to reduce your tax liability and maximize your returns over time. The tax implications of investing in these accounts will depend on your individual circumstances, so it's essential to consult with a tax professional or financial advisor to determine the best approach for your needs.

In conclusion, investing in Vanguard can be a great way to achieve your long-term financial goals. By following these 5 Cap Vanguard tips and avoiding common mistakes, you can set yourself up for success and make the most of your investments. Remember to start with a solid foundation, keep costs low, be patient and disciplined, rebalance your portfolio regularly, and take advantage of tax-advantaged accounts. With the right approach and a solid understanding of the basics, anyone can become a successful investor. We hope this article has provided you with valuable insights and information to help you on your investment journey. If you have any further questions or comments, please don't hesitate to share them with us.