Intro

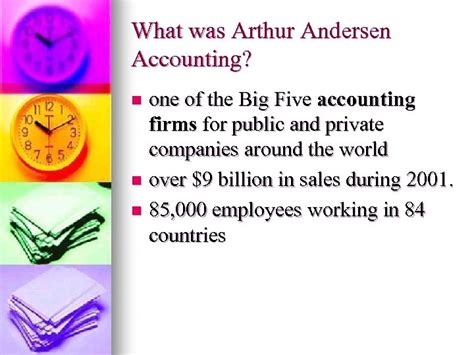

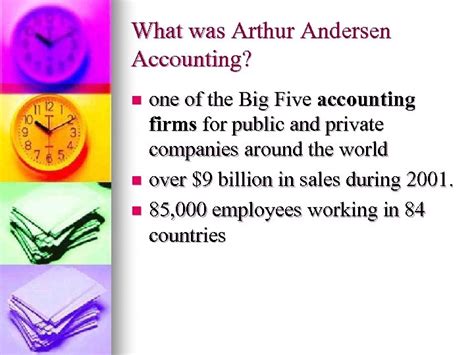

Discover Arthur Andersens rich accounting firm history, from its founding to demise, exploring auditing, consulting, and tax services that shaped the industry, including Enron scandal and legacy impact.

The history of Arthur Andersen Accounting Firm is a long and complex one, spanning nearly a century. From its humble beginnings to its rise as one of the largest and most respected accounting firms in the world, Andersen's story is one of innovation, perseverance, and ultimately, downfall. The firm's legacy continues to influence the accounting industry today, serving as a reminder of the importance of ethics, integrity, and transparency in business.

The early years of Arthur Andersen were marked by a commitment to excellence and a passion for innovation. Founded in 1913 by Arthur Andersen and Clarence DeLany, the firm quickly established itself as a leader in the field of accounting. Andersen's vision for the firm was centered around providing high-quality services to clients, while also fostering a culture of integrity and professionalism. This approach resonated with clients and helped the firm grow rapidly, with offices opening across the United States and eventually around the world.

As the firm expanded, it began to develop a range of services beyond traditional accounting. Andersen's consultants worked with clients to implement new technologies, improve operational efficiency, and develop strategic plans for growth. This expansion into consulting helped the firm stay ahead of the curve, as businesses increasingly looked for ways to leverage technology and data to drive decision-making. The firm's expertise in areas such as risk management, tax planning, and financial reporting also made it a trusted advisor to companies navigating complex regulatory environments.

One of the key factors that contributed to Arthur Andersen's success was its commitment to training and development. The firm invested heavily in its people, providing extensive training programs and opportunities for professional growth. This approach helped attract top talent from around the world, as aspiring accountants and consultants sought out the firm's renowned training programs. Andersen's culture of excellence and continuous learning also fostered a sense of community and camaraderie among employees, who were encouraged to share knowledge, collaborate on projects, and support one another in their professional development.

Expansion and Innovation

As the 20th century progressed, Arthur Andersen continued to expand and innovate. The firm was at the forefront of developments in accounting and auditing, introducing new methodologies and technologies that improved the efficiency and effectiveness of its services. Andersen's consultants worked with clients to implement cutting-edge systems and processes, from enterprise resource planning (ERP) systems to advanced data analytics tools. The firm's expertise in areas such as supply chain management, financial planning, and human capital management also made it a trusted advisor to companies seeking to optimize their operations and improve performance.

The 1980s and 1990s saw significant growth and change for Arthur Andersen. The firm expanded its presence globally, opening offices in new markets and acquiring smaller firms to bolster its capabilities. Andersen's consulting practice continued to thrive, with the firm working on high-profile projects for clients such as IBM, General Motors, and Procter & Gamble. The firm's audit practice also remained strong, with Andersen serving as auditor for many of the world's largest and most complex companies.

Challenges and Controversies

Despite its many successes, Arthur Andersen faced significant challenges and controversies in the late 1990s and early 2000s. The firm's consulting practice had grown rapidly, and some critics argued that this had created conflicts of interest with the firm's audit practice. Andersen's work with companies such as Enron and WorldCom also raised questions about the firm's independence and objectivity. In 2001, the firm was sued by the Securities and Exchange Commission (SEC) over its role in the Enron scandal, and the following year, Andersen was convicted of obstructing justice in connection with the case.

The aftermath of the Enron scandal was devastating for Arthur Andersen. The firm's reputation was severely damaged, and many of its clients began to question its integrity and trustworthiness. In 2002, the firm surrendered its accounting licenses and ceased to operate as an independent entity. The majority of Andersen's assets and operations were acquired by Deloitte, one of the other "Big Four" accounting firms.

Legacy and Impact

Despite its downfall, Arthur Andersen's legacy continues to influence the accounting industry today. The firm's commitment to excellence, innovation, and integrity helped shape the profession and raise standards for accounting and auditing practices. Andersen's emphasis on training and development also helped establish the importance of ongoing education and professional growth for accountants and consultants.

The firm's history also serves as a cautionary tale about the dangers of conflicts of interest, the importance of independence and objectivity, and the need for transparency and accountability in business. The Enron scandal and Andersen's subsequent downfall led to significant reforms in the accounting industry, including the passage of the Sarbanes-Oxley Act in 2002. This legislation imposed new regulations on publicly traded companies and their auditors, with the aim of preventing similar scandals in the future.

Key Takeaways

Some key takeaways from the history of Arthur Andersen include:

- The importance of independence and objectivity in accounting and auditing practices

- The need for transparency and accountability in business

- The dangers of conflicts of interest and the importance of managing these risks

- The value of ongoing education and professional growth for accountants and consultants

- The impact of regulatory reforms on the accounting industry and the importance of compliance with laws and regulations

Gallery of Arthur Andersen Accounting Firm

Arthur Andersen Accounting Firm Image Gallery

What was the main reason for Arthur Andersen's downfall?

+The main reason for Arthur Andersen's downfall was its involvement in the Enron scandal and subsequent conviction for obstructing justice.

What was the impact of the Enron scandal on the accounting industry?

+The Enron scandal led to significant reforms in the accounting industry, including the passage of the Sarbanes-Oxley Act, which imposed new regulations on publicly traded companies and their auditors.

What is the legacy of Arthur Andersen today?

+Arthur Andersen's legacy continues to influence the accounting industry today, with a focus on excellence, innovation, and integrity. The firm's history serves as a cautionary tale about the dangers of conflicts of interest and the importance of transparency and accountability in business.

In conclusion, the history of Arthur Andersen Accounting Firm is a complex and multifaceted one, marked by both significant achievements and devastating setbacks. As we reflect on the firm's legacy, we are reminded of the importance of ethics, integrity, and transparency in business, and the need for ongoing education and professional growth in the accounting industry. By learning from the successes and failures of Arthur Andersen, we can work towards creating a more responsible and sustainable business environment for the future. We invite you to share your thoughts and comments on the history of Arthur Andersen and its impact on the accounting industry. Your insights and perspectives are valuable to us, and we look forward to hearing from you.